Video on Demand in Europe — VoD Europe

04 May 2015

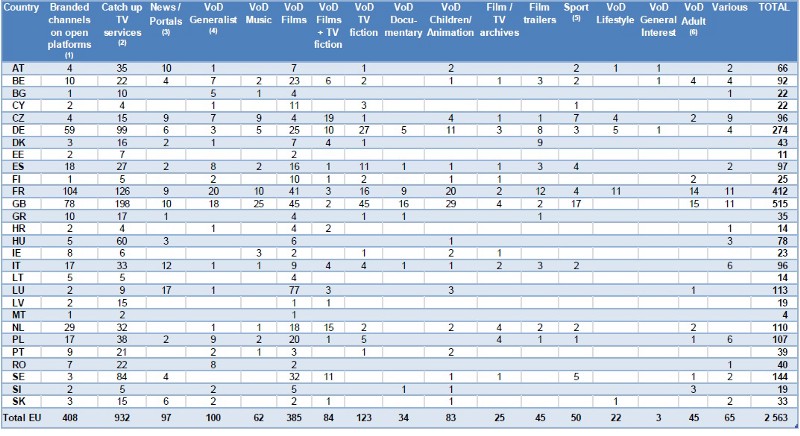

Video-on-demand (VoD) services remain somewhat fragmented in Europe, but Based on the categorization of on-demand audiovisual services by the Below is the number of studies show that the VoD Europe market is on its way to becoming more profitable in the following years as the market matures. MAVISE database — the Database on TV and on-demand audiovisual services and companies in Europe, — the VoD Europe services by country of establishment and genre (data by MAVISE/OBS, chart excerpted from the European Commission’s study The Development of the European Market for on-demand Audiovisual Services ). VoD European market summarizes 2.563 services, as of December 2014.

Hence, the most established on-demand audiovisual services in Europe are catch-up television services (932), broadcaster-branded channels services (408), and VoD Films services (385). Three countries lead the way, the United Kingdom, France, and Germany having the highest number of established VoD services in Europe: the UK, 515 established on-demand audiovisual services, France, 412, and Germany, 274. On-Demand Audiovisual Markets in the European Union revealed. However, the VoD market has yet to fully establish itself in Europe.

Hence, the most established on-demand audiovisual services in Europe are catch-up television services (932), broadcaster-branded channels services (408), and VoD Films services (385). Three countries lead the way, the United Kingdom, France, and Germany having the highest number of established VoD services in Europe: the UK, 515 established on-demand audiovisual services, France, 412, and Germany, 274. On-Demand Audiovisual Markets in the European Union revealed. However, the VoD market has yet to fully establish itself in Europe.

- In Europe, revenue for video-on-demand services is higher for subscription video on demand, the SVoD business model being one of the fastest-growing in the EU.

- According to Digital TV Research, monthly subscriptions for SVoD will rise to 59.41 million in 2020 from 17.99 million subscriptions in 2014.

- Following, revenues from online TV and video in Europe will grow from $4,804 million in 2014 to $12.872 million in 2020. (Digital TV Research)

- Revenues in Italy are expected to rise from $66 million in 2010 to $1.237 million in 2020. (Digital TV Research)

- Russia is also expected to gain more revenue from video and online TV, reaching $874 million by 2020 from $20 million in 2010. (Digital TV Research)

- Over the top (OTT) SVoD services, and OTT video, will drive the adoption of digital video in Europe. (The Development of the European Market for on-demand Audiovisual Services )

- In Europe, the total revenue from online television and video subscription is expected to climb to $5.5 billion in 2020 from 1.6 billion in 2014. The market is indeed developing rapidly, and as video-on-demand surges in Europe, so does the online video advertising market, which is expected to grow from €764 million in 2011 in Western Europe to €1.768 million in 2017, the European Commission study says.